Both financial professions work with financial information in similar ways, but for different purposes and uses. Margin analysis is primarily concerned with the incremental benefits of optimizing production. Margin analysis is one of the most fundamental and essential techniques in managerial accounting.

What are the Best States to Start a Business?

However, managers need more detailed information about the cost of each of several hundred products. Whether or not you aspire to become an accountant, understanding financial and managerial accounting is valuable and necessary for practically any career you will pursue. Management of a car manufacturer, for example, would use both financial and managerial accounting information to help improve the business.

Financial Accounting Defined

ERP modules are integrated into one complete system and share a common database to streamline processes and information across the enterprise. Some companies may use management accounting to do all of these things, but most businesses only use some of these functions based on their needs. Management accounting is designed to help managers make decisions, so individual practices vary widely based on the specific needs of managers in a particular team, department, managerial accounting or company. Management accounting is extremely important for businesses because it allows them to translate hard data about their finances into reports that can be analyzed and used for strategic business decisions. After all, financial accounting doesn’t mean anything if you don’t apply the insights to your plans and decisions for your business. Like financial accounting, management accounting is often aided with the use of accounting software.

General and Administrative Costs

Then, there are business owners who stay stuck in analysis paralysis and never start. The best way to accomplish any business or personal goal is to write out every possible step it takes to achieve the goal. In the short span of the 21st century, faster Internet speeds and new development tools have again revolutionized ERP suites.

- Managerial accounting, in contrast, uses pro forma measures that describe and measure the financial information tracked internally by corporate managers.

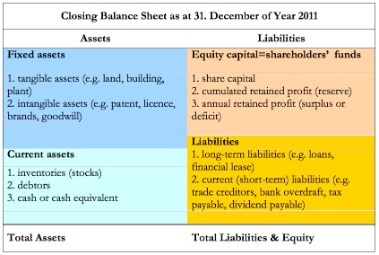

- It compares the inflow and outflow of funds as documented in two comparative balance sheets.

- Custom Furniture Company’s income statement for the month ended May 31 is shown in Figure 1.8 “Income Statement for Custom Furniture Company”.

- The performance of a whole company, each department and each employee are considered at the end of each term in performance reports.

Who are the Users of Managerial Accounting Information

Cash flow analysis studies the impact of a single financial decision or transaction to see the true impact of that purchase or decision. Financial professionals may look at several options and ways to finance a purchase based on that analysis. Cash flow analysis lets organizations make informed financial decisions and maintain sufficiently liquid assets in the short term. Financial accounting is the process of preparing and presenting quarterly or annual financial information for external use. Financial accounting reports may entail audited financial statements that help investors decide whether or not to buy or sell a given company’s stock. In business, financial accounting refers to the act of recording a company’s financial transactions, which are typically examined by investment banking analysts and shareholders of public corporations.

- Going to an ERP system is probably not appropriate if management is simply looking for a few reports beyond what most financial accounting systems can provide.

- The bookkeeper also inputs budget information and provides monthly financial reports to the treasurer.

- The answer to this question will depend on the type of business you want to start and where you’re located.

- Jeff, the controller, approaches Sarah and asks her to think of a way to increase profits by $2,500,000.

- Cash flow analysis is the examination of these inflows and outflows of cash during a particular period under consideration.

- Financial professionals typically use reports like balance sheets and debt-to-equity ratios to help companies determine borrowed capital amounts.

Profit margins are then estimated and monitored in accordance with company goals. A proper understanding of costs and profit margins helps a company to optimize resources for increased productivity. Budgets or budget managerial reports are reports on which other managerial accounting reports and activities are based. Reports generated from managerial accounting are done relative to the budget of a company.

Management accounting

Develop a Scalable Business Model